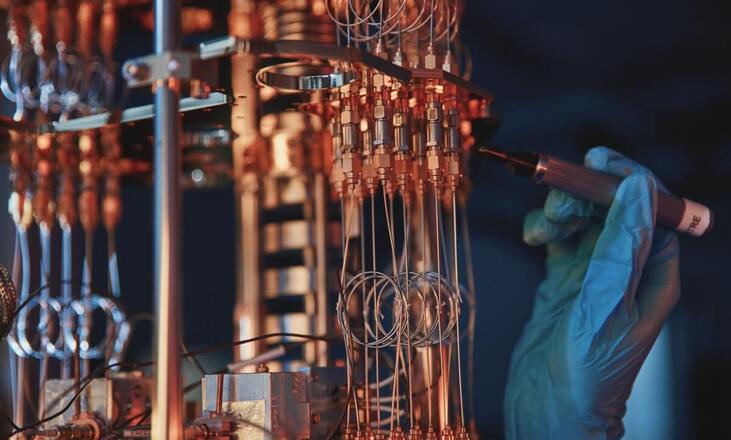

Flexential, a provider of secure and flexible data center solutions, has released research indicating that enterprises are planning AI-related infrastructure needs earlier than traditional IT requirements. The 2025 State of AI Infrastructure Report reveals that nearly 80% of organizations are planning data center capacity over a year in advance, with some looking up to five years ahead.

The study found 62% of IT leaders plan one to three years ahead, while 17% plan three to five years in advance. This extended planning reflects the investment scale and long procurement times for AI deployments, requiring significant computing, storage, and power. Despite 94% expressing confidence in their planning, the report suggests this may be misplaced. Notably, 16% plan less than a year ahead, yet 70% of them feel prepared, despite a constrained AI infrastructure market.

Flexential’s survey included over 350 IT leaders from companies with at least $100 million in revenue, with about 100 from firms exceeding $2 billion. Respondents discussed readiness, workforce challenges, and AI scaling strategies. Findings indicate tightening data center vacancy rates, extended infrastructure lead times, and risks of missed opportunities if decisions are delayed. The report emphasizes that new capacity deployment requires more than the traditional two-year planning window to stay competitive.

Organizations with secured infrastructure still face performance issues. Nearly 60% reported bandwidth shortages, and over half noted excessive latency, highlighting the importance of network performance alongside computing power. In response, companies are blending private and public solutions to balance performance and cost, with many adopting colocation to supplement cloud workloads.

Workforce constraints are another challenge. Only 5% reported no AI-related skills gaps in the past year. The most significant shortfall is in specialized computing infrastructure expertise, cited by 61%. Skills shortages in data science and engineering (53%) and advanced networking technologies (47%) were also common. Beyond technical skills, enterprises face broader hiring and retention challenges, with over half citing a lack of upskilling programs or difficulty finding candidates with advanced AI experience. Despite these obstacles, only 10% identified talent scarcity as their primary AI adoption barrier, with most viewing infrastructure as the more urgent concern.

The report provides insights into deployment structures. The public cloud is the most used environment for AI training data, chosen by 68%. Colocation facilities are gaining traction, with 54% using them for storage and performance needs. On-premises data centers play a reduced role, with 20% storing training data locally and 36% planning to use them for training or inference workloads. GPU-as-a-service is becoming more common, now used by 40%, up from 34% a year earlier. Public cloud GPU usage also rose from 30% to 34%.

Enterprises are addressing workforce needs with training initiatives. All surveyed organizations offer some form of AI training through embedded tools, in-house programs, or external certifications. This reflects the recognition that workforce preparation must evolve alongside infrastructure to realize AI’s potential fully.

The research emphasizes that building AI-ready infrastructure is a long-term endeavor requiring foresight. Bringing new capacity online takes years, not months, and enterprises that fail to plan risk lacking resources when demand peaks. Early movers align infrastructure with strategic ambitions and integrate energy efficiency and sustainability into future capacity. Flexential notes strong demand in metropolitan hubs like Atlanta, Dallas, and Denver, where it continues to expand.

The report concludes that as AI adoption accelerates, planning horizons will stretch further. Enterprises viewing infrastructure readiness as a competitive advantage, rather than a technical requirement, are better positioned to capture opportunities in a capacity-constrained market.